44+ rising rates are battering mortgage lenders

Web WASHINGTON March 10 2022 PRNewswire -- A majority of mortgage lenders continue to expect near-term profitability to decrease amid rising mortgage rates and declining refinance. I wish I understood financing better.

Fed Raises Interest Rates Smart Money Moves To Make Now Fox Business

Mphasis Expects Weak Us Mortgage Business To Weigh Down Revenue.

. Web Rising Rates Are Battering Mortgage Lenders Summary by Wall Street Journal Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Current Mortgage Rates for February 2023 Current Refinance Rates for February 2023 The current average rates for mortgage refinances are. Trends Technologies - speicherguidede GER January 25 2023.

Web Mortgage Rate Increase Hits Lenders as Refinancing Surge Fizzles The phones are going quiet for many home-loan brokers Thirty-year fixed mortgage is at highest level in 9 months. The Wall Street Journal What rising mortgage rates mean for your HELOC PhD. Web Mortgage lenders typically offer lower interest rates to borrowers who go shorter than 30 years because the shorter term means the lender recoups its investment faster.

While the latter is still a competitive rate in the grand scheme of. Web She is stating that we need at least 20 down but that our interest rate is going to be between 2-4 higher than the current average mortgage rates even with 20 down. Navy Federal Credit Union Home Point Financial.

Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Web On Jan. The issue we are facing now is that the unsustainable gold rush of historically low interest rates are.

While home prices continue to rise and Americans are still buying houses the drop-off in refinancing activity is a giant blow because refinancings made up the bulk of US. Web The law also gave lenders an incentive to offer qualified mortgages or loans designed to be easy for borrowers to understand and to have predictable payments Stein said. Treasury bond yields rising inflation and the Feds actions to contain it by hiking the federal funds rate tend to push mortgage rates upward.

In March mortgage lenders made 236 in profit on every 100 of a loan the smallest amount since 2019 according to the Urban Institute. Web Rising Rates Are Battering Mortgage Lenders The Wall Street Journal May 25 2022. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise.

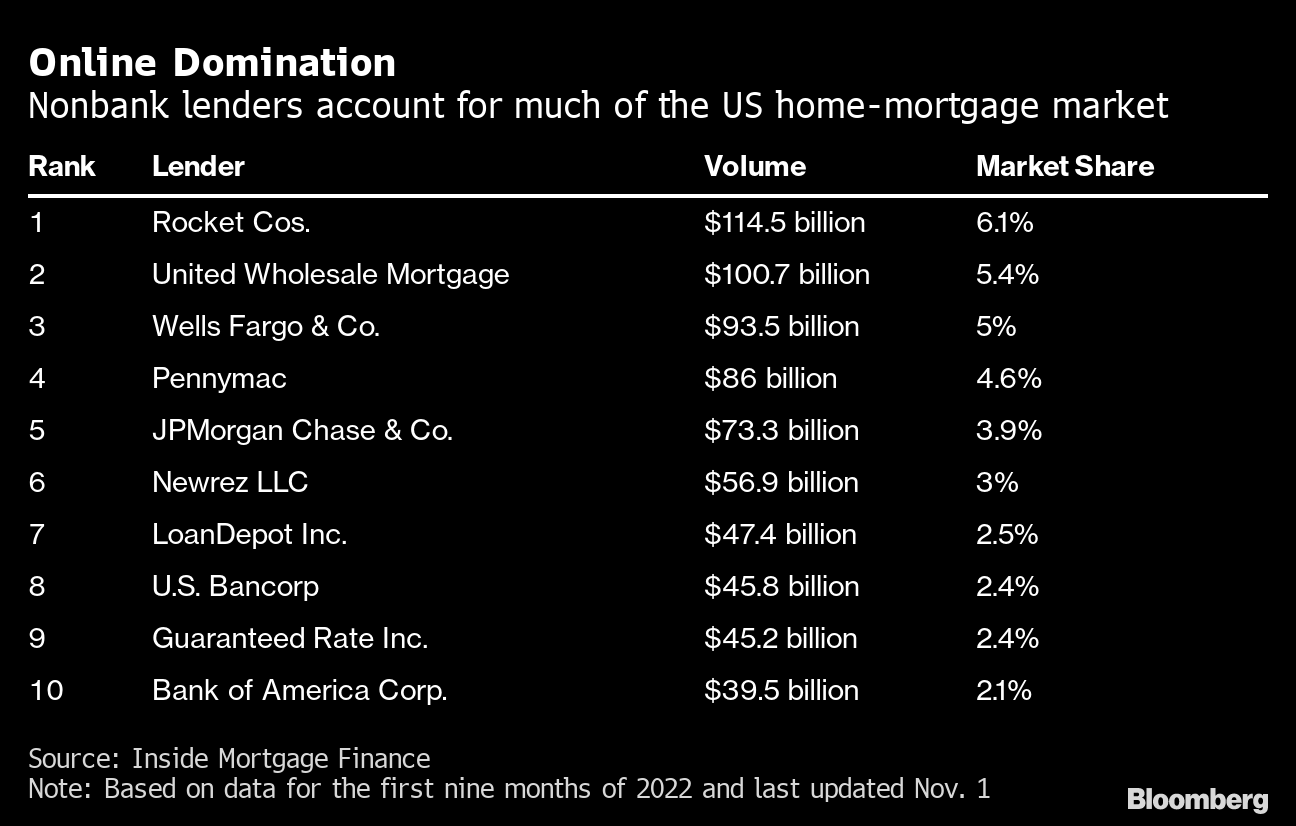

Coverage Report Quarter results Q3 23. Web The ten lenders with the best mortgage rates on average are. Web Mortgage rates were at record lows in 2020 and 2021 but theyve been increasing in 2022.

Mortgage Finance and Banking Real Estate Please note that in order to view the content for the Bankruptcy Headlines you must either sign in if you are already an ABI member or otherwise you. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. 14 the interest rate jumped to 2856.

In 2020 that figure was as high as 599. Web Check your rates today with Better Mortgage. Web Wall Street Journal May 25 2022Orla McCaffrey subscriptionMortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest.

Web Some lenders are selling assets such as their rights to collect mortgage payments. The 30-year rates could jump above 4 this year but thats still low compared to a few years ago. Others are trying to drum up business by offering lower rates or cutting their fees.

1 the average interest rate for a 30-year mortgage was 2765. Web Its so easy to forget the times when the interest rates never dropped below 6-7 percent. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise.

Students demand wage increases amid rising cost of living The Rising of the Shield. Web While mortgage rates are directly impacted by US. With our combined income we wouldnt have any issue getting approved for the mortgage value one a single family home at this value.

Web Rising Rates Are Battering Mortgage Lenders ABI Rising Rates Are Battering Mortgage Lenders Wednesday May 25 2022 Article Tags.

Mortgage Interest Rates Mortgage Business Fall By More Than 40 Owing To Surge In Interest Rates The Economic Times

1 The Mortgage Market Download Scientific Diagram

Why The 10 Year Treasury Yield Is At Record Lows

Mortgage Lending Is Down Sharply Nationwide As Interest Rates Rise But The Philly Area Bucks Trends

What Are Mortgage Lenders Options In A Rising Rate Environment

Rising Rates Are Battering Mortgage Lenders Wsj

Weathering The Coming Storms Waves In Mortgage Finance Risk Forvis

Mortgage Giant Rocket Plunges Back To Earth Hit By Rising Rates Wsj

Americans Are Taking Cash Out Of Their Homes And It Is Costing Them Wsj

Rising Rates Are Battering Mortgage Lenders R Realestatefinance

Mortgage Applications Fall 14 As Higher Rates Hurricane Ian Crush Demand

Rising Rates Are Battering Mortgage Lenders R Rebubble

Mortgage War Rejoined As Uk Market Confidence Grows Financial Times

British Mortgage Lenders Well Placed To Cope Even In Brexit Doomsday Scenario S P Global Market Intelligence

European Bonds Start 2023 With Rally On Bets Inflation Will Slow Bnn Bloomberg

Liz Truss S Tax Cut Gaffe Hits Tories In The Pocket Five Charts Bnn Bloomberg

Mortgage Demand Falls As Interest Rates Surge To Multiyear Highs